Bring simplicity to your field service operations.

Our list of integrations is updated frequently. Explore each integration in its own separate page for more information.

In Europe and Western regions, new construction and reconstruction projects are being planned every day, which significantly adds up to a positive forecast.

However, the more projects are carried out, the more the construction industry faces limitations. From unsustainable materials and machinery equipment to time and cost wasting procedures, but the great news is that 2022 is bringing new construction equipment trends that are about to challenge these concerns and bring the sector to a modern and sustainable future.

Although cloud technology, artificial intelligence, and smart cities are becoming buzzwords, they are transforming the machine-building and construction sector as we know it. So, we collected the five most significant technology trends that will influence the construction industry in 2020 and the following years.

Machine learning and AI are a solution to help manufacturers deal with an aging workforce and the lack of professional talents. AI-powered machines could open doors for faster and more precise manufacturing, thereby reducing production costs and development time. While AI could solve a workforce problem, it could also make the equipment sector more intuitive and adjustable.

For instance, some construction companies are already experimenting with AI-operated wind turbines that adjust to weather conditions and can forecast weather and wind changes. It could improve not only work efficiency but also help with disaster management.

As much as cloud computing sounds futuristic, many current field service companies, including heavy machinery, use cloud technology to boost their business. The technology helps to manage equipment remotely and share data much faster.

Of course, our attention goes to cloud-based SaaS solutions that benefit the heavy machinery sector. An interesting fact, by 2022, it’s predicted that 75% of all cloud workloads and compute instances will be SaaS. Then it comes as no surprise when construction and equipment companies start looking for innovative ways to manage their business.

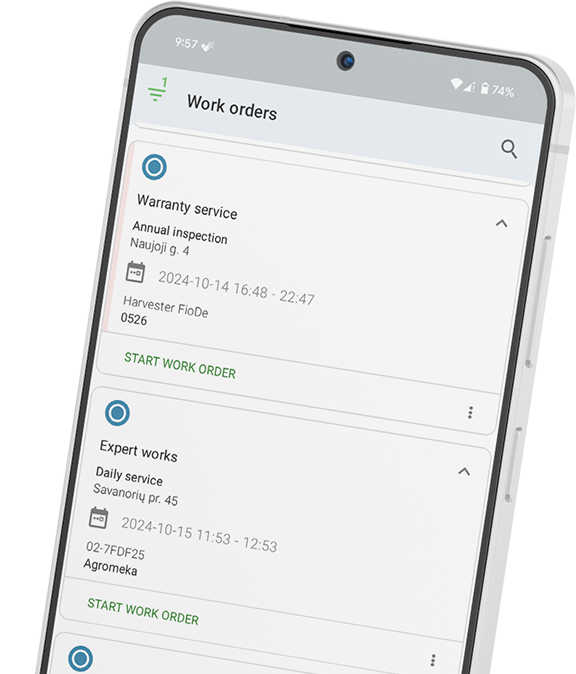

For instance, heavy equipment field service management software can eliminate manual work and increase performance efficiency. Instead of making calls with clients, planning your employees’ schedules, and on top of trying to juggle administrative work, a system could do it for you. And as for now, it’s an option, but in the near future, it will be difficult to compete in the industry using only manual planning methods.

The construction equipment rental business is picking up steam and seems to be habing a positive impact on the construction machinery global market. According to the Construction Equipment Rental Association (CERA), developed and developing countries like China, and India are expected to witness increasing demand for construction equipment rental services.

Construction equipment manufacturers in these regions will define the entire construction sector by committing to the rental service model. The major sectors projected to bring substantial revenue and future growth are oil and gas, public infrastructure, utility and electrical, and commercial and residential construction. Rental companies are here to stay and more engagement is expected throughout 2022.

Rapid prototyping, 3D printers, and advanced CNC machines make engineering equipment manufacturing much more accessible and affordable. Designing a machine or a structure used to take months, and it used to be difficult to spot flaws and make changes without affordable prototyping. Now, you can use modeling and designing software and have your idea turned into a form within hours.

Modern machines are navigated via computer systems, which enables designers and engineers with less software experience to produce prototypes and use manufacturing tools.

Robotic devices increase workplace safety and efficiency. What used to take days, if not months to produce, now can be done within minutes. Robotized equipment can perform during night hours and weekends, thereby speeding up manufacturing processes and saving production costs.

Asia-Pacific dominates the construction equipment market, with significant market share in China, India, and Japan. The progress of the South-North water transfer plant project in China, which will run through to 2050, will require different types of construction machinery, subsequently increasing the demand for construction machinery over the next three decades.

The Asia-Pacific market demand for infrastructure projects such as dams, commercial and residential complexes, and rail and road development, will naturally drive significant growth in the construction equipment industry.

Companies are adopting a more regional outlook on projects. Take Komatsu LTD and their announcement about rolling out affordable excavators in the Asia-Pacific region back in 2020. Komatsu LTD is one of many major companies that are changing the competitive landscape of the construction equipment market.

Construction equipment industry manufacturers are trying to move away from gasoline and diesel, as regulation in the area is introducing ideas like carbon-neutral, renewable energy, and air quality. To prove the changing market dynamics you don’t have to look far as earlier this year, Komatsu LTD announced a partnership with Proterra to use battery packs in Komatsu’s electric hydraulic excavators.

Coming off a difficult 2020 industries like construction, mining, and agriculture are picking up steam as both consumers and manufacturers are more confident about the economy.

“The good sales volumes, not least in the service business, and our own measures to keep costs down contributed to the adjusted operating income improving to SEK 11.8 billion (7.1). The adjusted operating margin increased to a historically high 12.6% (7.8),” says Martin Lundstedt, President and CEO, Volvo Group, in the company’s press release announcing its first-quarter 2022 results.

The Volvo Construction Equipment press release notes that net sales increased 13% on an adjusted currency basis.

Volvo Construction Equipment (Volvo CE) also reported a Q1 2022 sales increase of 23% attributed to more construction projects. According to the press release, the company’s first-quarter results showed that it experienced a sharp increase in orders—up 73%—compared to the previous year.

The company states that the increasing demand in the Chinese construction equipment market was a byproduct of government infrastructure investments. Sales saw an increase in all major locations across the global market. Volvo CE points out that demand for large- and medium-sized machinery was stronger during Q1 than for compact machines.

Volvo CE notes it was a slow start for the European construction equipment market in the first quarter because of the COVID-19 pandemic and the restrictions that affected the construction equipment market as a whole. Since the start of 2022, the market has adjusted and global vaccination schemes have brought a positive impact.

Net order intake in Europe increased 87% due to stronger demand in the second half of the quarter, although the company notes Europe’s total market development has declined 9%. Additional market improvements included:

Moving on from Volvo and the North American market, construction equipment demand increased in the UK contributing to a 30% rise in sales during Q1 2022, as per the Construction Equipment Association (CEA) press release. According to first-quarter figures, retail sales for construction equipment in March doubled in comparison to the same month of 2020. This lead to an increase in Q1 sales, with total units sold reaching over 8,000 units.

CEA notes in its press release sales were also 2.9% above 2019 levels, showing a broader increase over a longer period of time.

Construction machinery and more specifically excavators were the main drivers for sales in the industry. The release points to mini/midi excavators (up to 10 tonnes) and other types of excavators seeing the strongest market growth during the quarter, with road rollers and telehandlers following suit with notable comebacks.

Moving over to the other side of the pond, the Association of Equipment Manufacturers’ (AEM) economic partner Oxford Economics reports the U.S. construction equipment market contracted 11.5% in 2020, once again showing the effects of COVID-19. The market estimates to enjoy a rise of 15.2% for the rest of the year. The proposed American Rescue Plan and another government stimulus will aid the recovery of the construction equipment market in 2022 and 2023.

Agricultural equipment demand was not affected as badly as other industries with only a 5.8% decrease in 2020 due to its outdoor nature. Strong consumer and export demand in the second half of the year helped the market recover, and this momentum is expected to continue into 2022 and grow 15.8%.

AEM’s most recent U.S. and Canada agricultural construction equipment market report shows the industry finished the first quarter of 2022 with huge momentum. According to the report, U.S. total farm tractor sales rose 84.1% in March while Canada saw positive sales in tractors.

According to Eric Raby, President & GM – Sales at CLAAS of America, demand for agricultural equipment is expected to be strong throughout 2022 and into 2022. Continued development of new technology will help drive customer demand he noted during a recent podcast interview with OEM Off-Highway.

The agricultural equipment market is showing promising signs all over the globe. FederUnacoma—the Italian agriculture industry association—reports registrations for farm machinery in Italy recorded an increase during the first quarter of 2022. Tractor registrations rose 57.7% while combine harvesters increased 180%. The association notes the increase in registrations is due in part to tax incentives from the government.

With governments around the world searching for ways to ensure more environmental-friendly and efficient infrastructure development, smart cities are vastly rising. At the same time, they change the way we see construction now. Buildings, green areas, and public facilities all have to be integrated into one automated infrastructure to bring a better life to its citizens.

These changes inspired the construction and machinery sectors to adopt new technologies and look for more sustainable and automated solutions.

Heading into 2022, the construction equipment market had to adjust to a rapidly changing workplace environment. The influx of digital technologies caused by COVID-19, and new workplace protocols are causing companies to rethink the way they do business.

Job sites had to ensure they followed the required safety standards, limiting the number of workers in an enclosed space and alterations in key job site processes. In terms of workforce, the construction equipment market has been slowly yet steadily adding new jobs and has largely recovered from the initial job losses of early 2020.

Despite this recovery, challenges due to talent shortages are still evident and will continue to be among the most talked-about themes of 2022. Bureau of Labor Statistics data suggests that since 2017, while the number of job openings has almost doubled, the number of new hires has increased by less than 10%.

Why is there a shortage of construction machinery talent? The answer is simple. There is an obvious skills gap because of the digital transformation era we live in. Employees are willing but don’t necessarily have the skills to adjust to technologies like drones and robotics.

Distributing equipment and materials can be a great pain due to delays, thefts, and counterfeiters. When a shipment is on its way, it’s almost impossible to follow it throughout the whole journey and ensure that goods are intact. With supply chain digitization, it could change. From manufacturers to the end-users, everything could be recorded and thereby secured from latter threats.

Of course, again, the project to this extent would require highly advanced technologies, but it’s something for heavy machinery and construction businesses to think about.

Smart technologies are taking the construction equipment business and equipment industry sectors by storm. There’s no need to wait and see what happens because modernization is already here. If you want your company to flourish in the times of digitization, you need smart business operation management software, too.

Implement cloud-based SaaS technology and save resources by reducing planning, dispatching, administering time. Frontu has you covered, check our FSM solution, and see yourself if it has what it takes to make your business successful in 2022.

Our list of integrations is updated frequently. Explore each integration in its own separate page for more information.

Link copied!